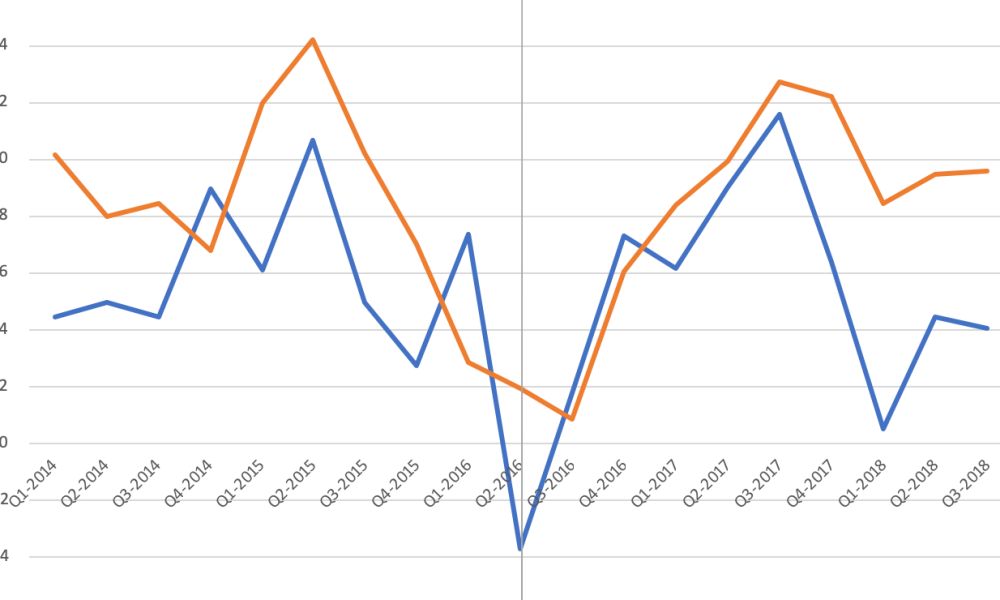

One obvious effect is that there has been an increase in volatility as investors adjust their portfolios to account for potential risks posed by Brexit. This increased volatility can lead to sudden drops or spikes in prices which can be difficult to predict or manage without careful analysis and planning. Another impact is that companies associated with Britain may face difficulties due to changes in trade agreements with other countries after Brexit takes effect. These changes could pose financial risks for businesses which could cause their stock prices to drop and become less attractive investments overall.

Finally, foreign investment into British stocks may become less attractive as uncertainty surrounding Britain’s future remains high. This could put downward pressure on UK stocks as fewer international investors are willing to put money into them due to perceived risk levels being too high compared to other markets around the world.

Overall, it is clear that Brexit has had an influence on the stock market and should not be ignored by investors looking for long-term growth opportunities. Careful research and analysis should be conducted before any decisions are made so that risks are properly assessed and managed appropriately in order to maximize returns while minimizing losses where possible. With this approach, investors should be able to weather any storms caused by Brexit while still achieving positive returns over time if they play their cards right.